How To Buy Bitcoin On eToro? Beginners Guide – 13 Easy Steps

If you want to know all the information about eToro and bitcoin, I can guide you through the process. Allow me to tell you what steps to take and what factors to consider to make the process smoother and more profitable. let me tell you. let’s discuss in more detail below how to buy bitcoin on eToro.

Table of Contents

Introduction

The world of cryptocurrency is evolving rapidly, and Bitcoin stands at the forefront as a pioneering digital asset. eToro, a leading social trading platform, has emerged as a user-friendly gateway for individuals seeking to explore the exciting realm of cryptocurrency trading. This comprehensive guide aims to walk you through the intricate process of buying Bitcoin on eToro, ensuring that you can navigate the platform with confidence and make informed investment decisions.

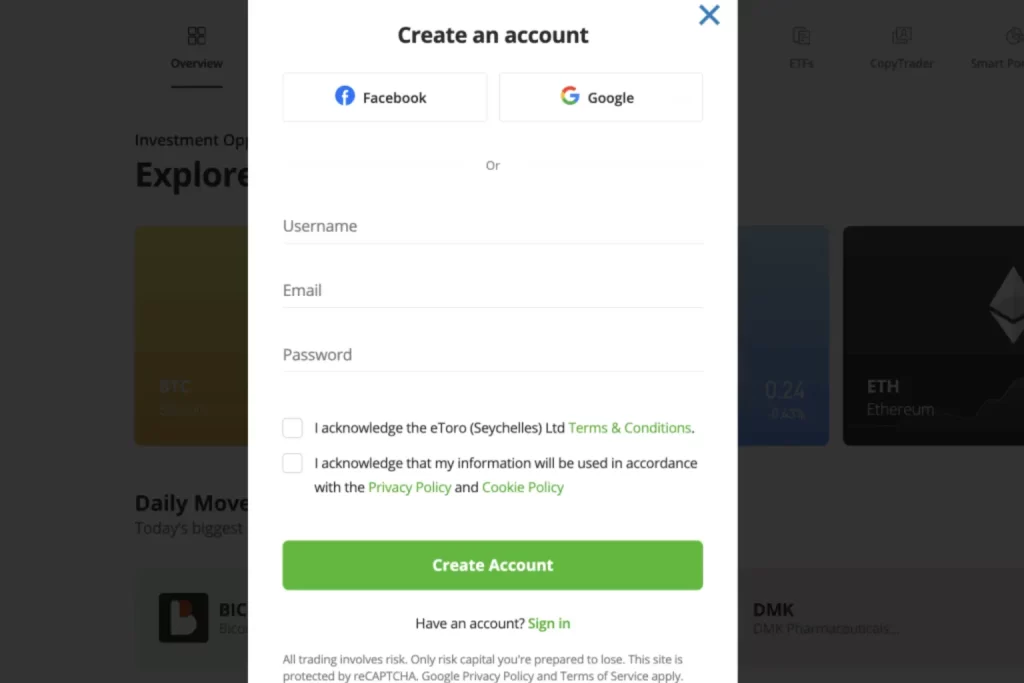

Step 1: Create an eToro Account

Embarking on your cryptocurrency journey with eToro is a straightforward process. Start by visiting the official eToro website and clicking the “Join Now” button. Input necessary details such as your valid email address, a secure password, full name, where you live, and your phone number. Additionally, eToro requires a tax ID number; for U.S. users, this means your social security number, while UK users can use their national insurance number. This step ensures that your identity is confirmed, keeping everything in line with regulations.

Following the completion of this information, eToro will send a code to your phone. Simply type in that code, and voilà, your account setup is complete. This quick and secure process ensures that everything is in order, allowing you to dive into the world of cryptocurrency trading on eToro hassle-free!

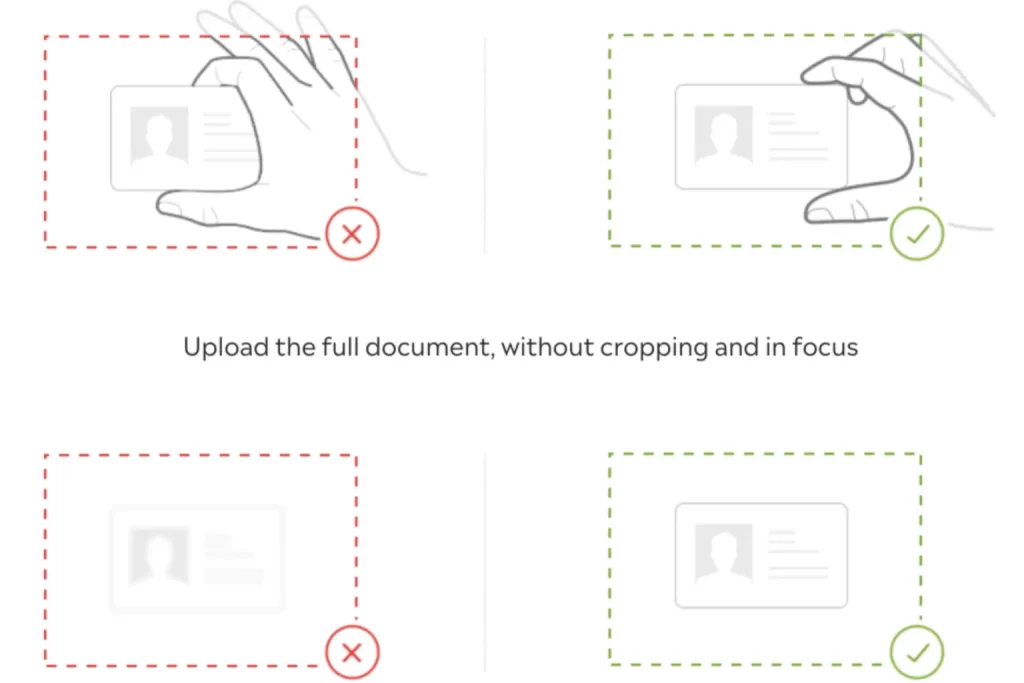

Step 2: Verify Your Account

As part of eToro’s commitment to regulatory compliance and security, verifying user identities is a crucial step. To do this, you’ll need to upload a clear copy of your government-issued identification, such as a passport or driver’s license. Additionally, proof of address is required, and you can provide this through a utility bill. The verification process is usually swift, and upon successful completion, you’ll receive a confirmation email.

In addition to identity verification, eToro also requires a document confirming your address. This document should display your full name, current address, and issue date, with a requirement that it’s from the last three months. eToro is flexible in accepting various document types, including bank and credit card statements, utility bills, official housing agreements, as well as council tax and phone bills.

To ensure a smooth process, it’s essential that the documents you upload are clear, with all four corners visible. This allows eToro to promptly review and confirm your account details. While eToro notes that the Know Your Customer (KYC) process may take a few days, in most cases, it happens almost instantly if your provided documents are valid, clear, and match the information initially provided. This extra step is in place to maintain security and ensure that everything is in proper order.

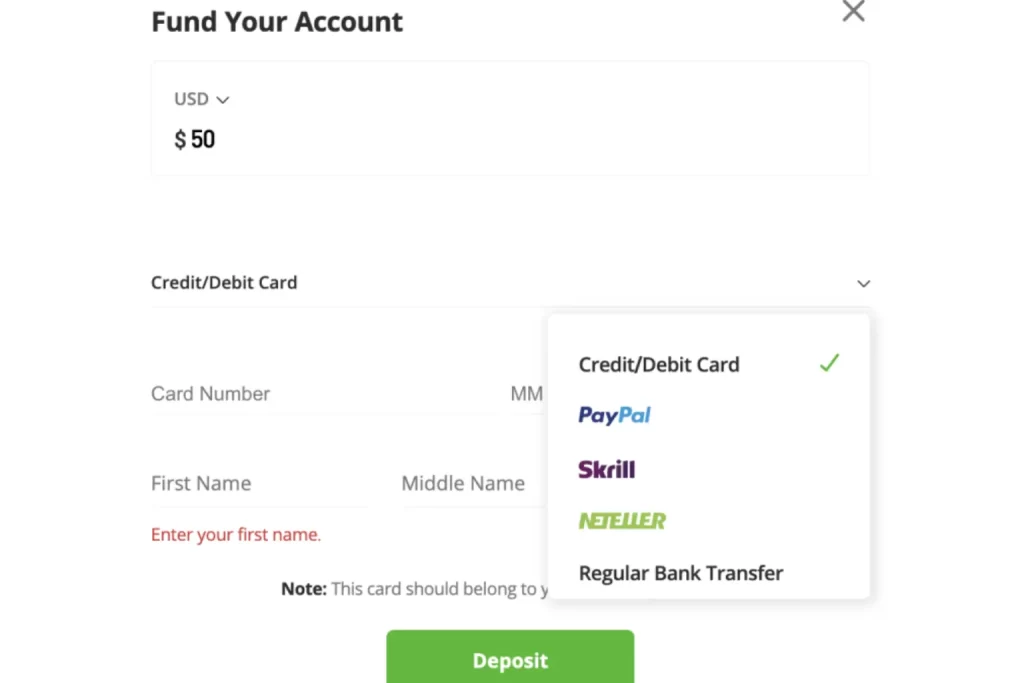

Step 3: Deposit Funds into Your eToro Account

Now that your eToro account is set up, it’s time to fuel your trading ventures. Click on the “Deposit Funds” option to choose your preferred payment method. Whether it’s a credit/debit card, bank transfer, or e-wallet, eToro provides a variety of secure options to cater to your needs. Follow the prompts to complete the deposit process, ensuring that your account is sufficiently funded for the exciting Bitcoin journey ahead.

Unlike Coinbase and Binance, eToro doesn’t have an ‘Instant Buy’ feature. This means you’ll need to deposit funds before buying Bitcoin. The good news is that eToro accepts various payment methods, such as debit/credit cards from Visa, MasterCard, or Maestro (excluding American Express). They also work with e-wallets like Skrill, PayPal, and Neteller, as well as local banking methods such as ACH (for the US) and Faster Payments (for the UK).

Once you’ve selected your preferred currency and payment method, specify the deposit amount. The minimum deposit on eToro is $50, but if you’re in the US or the UK, you can deposit as little as $10. After making your decision, click the ‘Deposit’ button to confirm your payment. This straightforward step ensures that your account is funded and ready for you to dive into the world of Bitcoin trading.

Note: eToro supports various currencies, its primary operating currency is US dollars. If your payment is in US dollars, no deposit fees will be incurred. However, for transactions in all other currencies, a 0.5% deposit fee is applied.

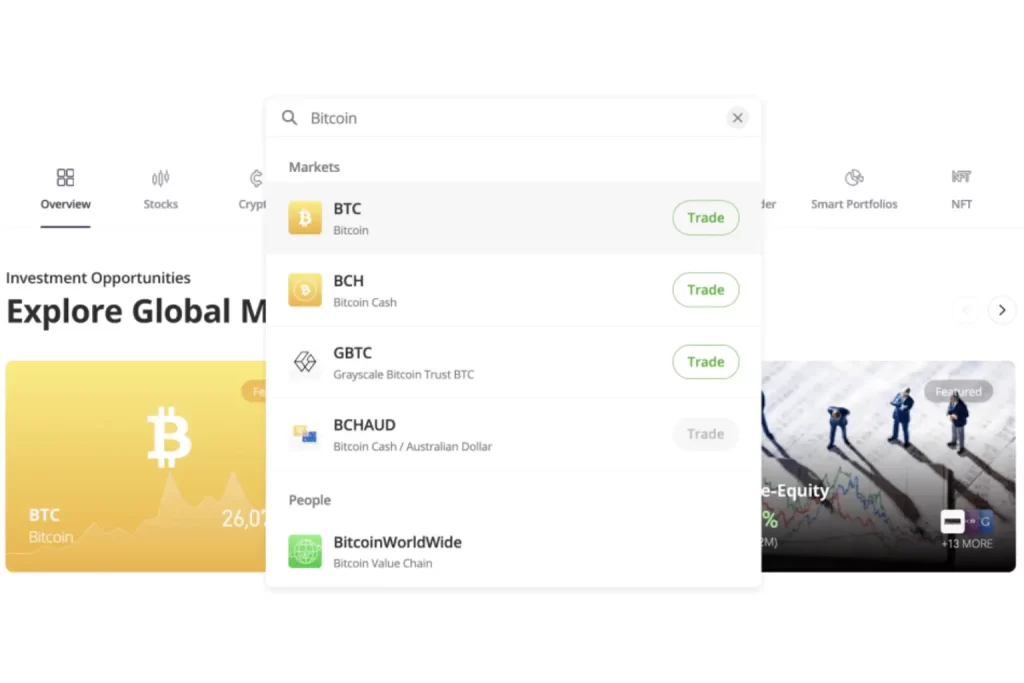

Step 4: Search for Bitcoin on the eToro Platform

Now, let’s find Bitcoin on the eToro website. Since there are a ton of markets, just use the search bar—it makes things way easier!

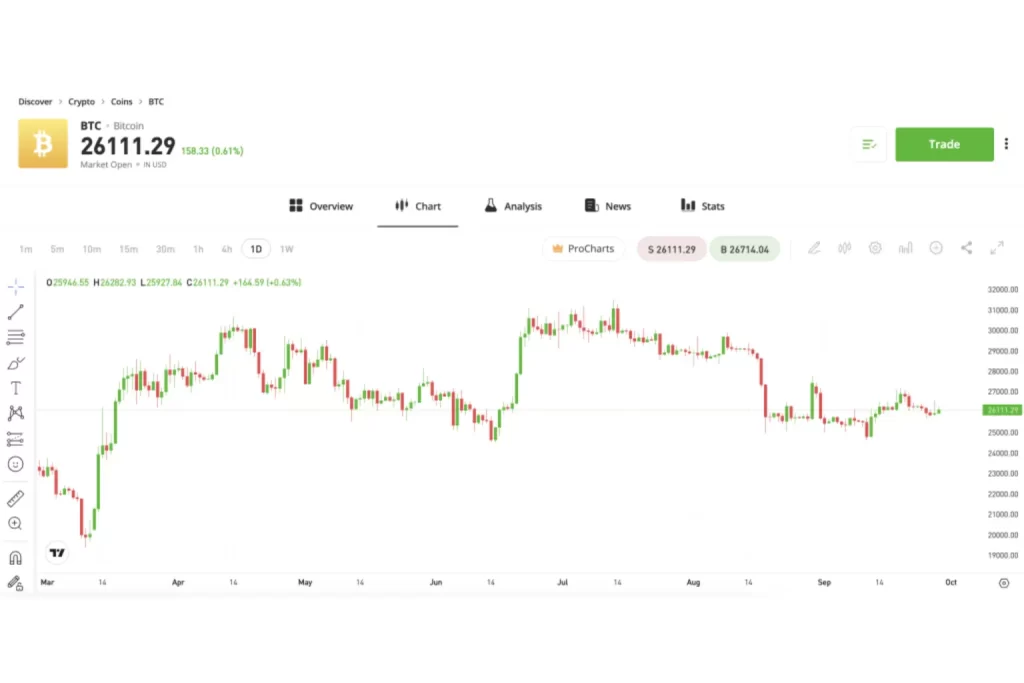

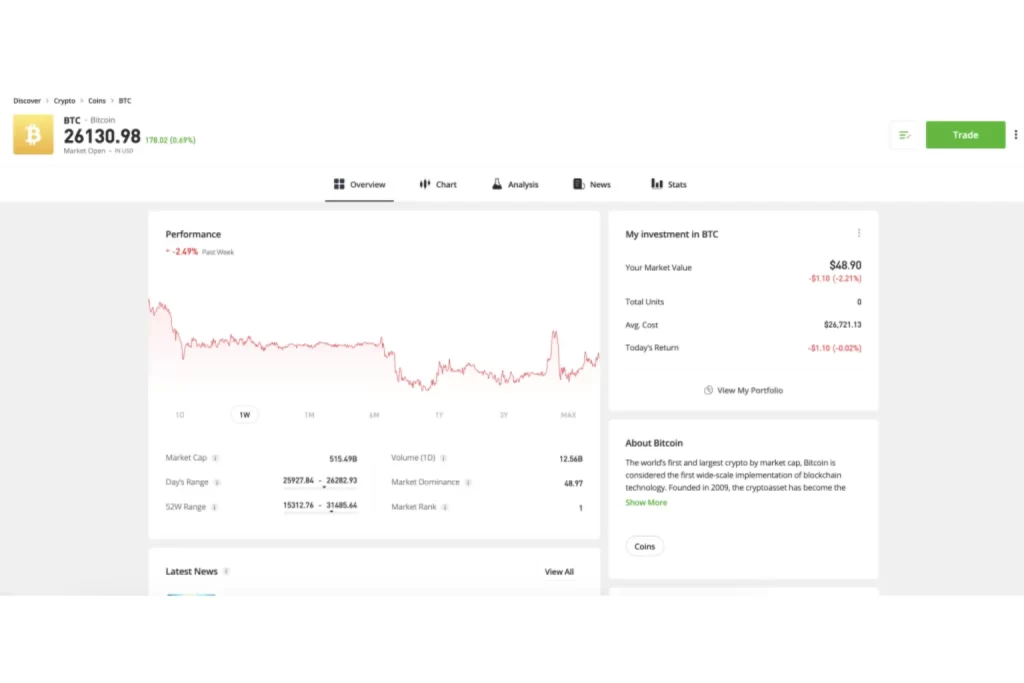

Navigating the eToro platform is user-friendly. To find Bitcoin, simply use the search bar at the top of the screen. Type in ‘Bitcoin’ or its ticker symbol, ‘BTC,’ and click on the top result. This action opens the dedicated Bitcoin trading page, providing a wealth of research data, including sell-side analyst ratings, pricing charts, and social indicators. If you’re ready to dive into trading, you can also click on ‘Trade’ to go straight to the eToro Bitcoin trading page.

Step 5: How To Buy Bitcoin On eToro

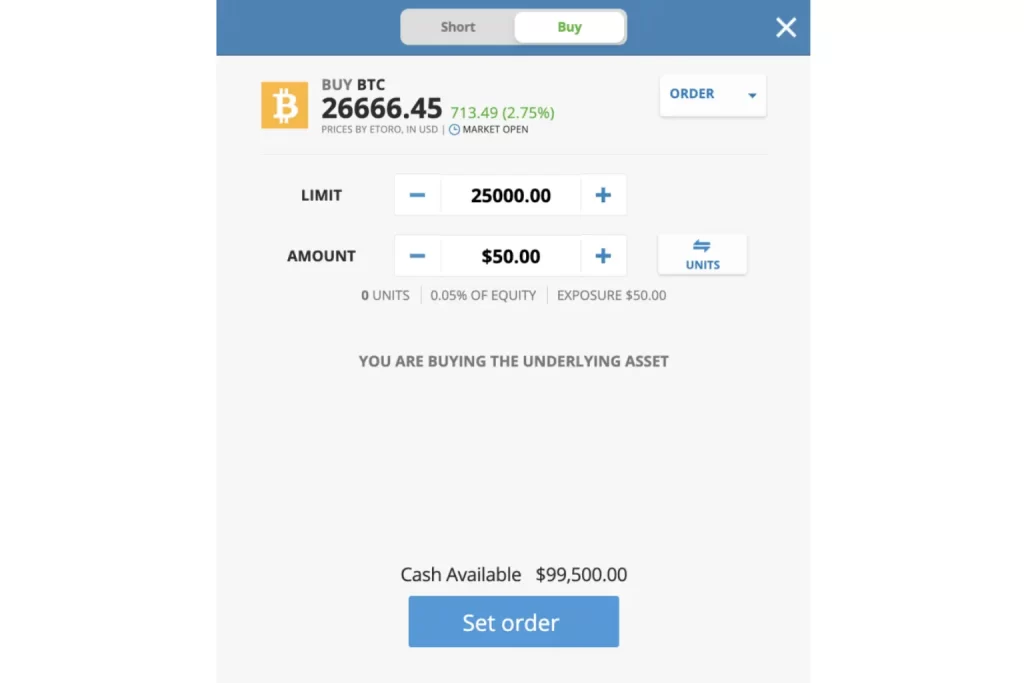

Now, you’ve got a box in front of you, ready to help you buy Bitcoin on eToro. The cool thing? eToro lets you choose between a ‘Market’ order or a ‘Limit’ order.

If you feel like being the boss, go for a Limit order. You get to decide the price you want. For example, if Bitcoin is hanging out at $26,666 but you’d rather snag it at $25,000, set your limit there. The order waits until the price hits $25,000, and then it’s a done deal.

Feeling a bit more spontaneous? Opt for a Market order. This means you’re getting Bitcoin instantly at the current market price. It’s perfect if you’re planning to hold onto Bitcoin for the long run.

Once you’ve made your call, it’s time to figure out how much you want to invest. No stress – eToro is for everyone. You can kick off with just $10. Let’s say, in our example, you’re putting in $50. Or, if you prefer, you can say how many Bitcoin ‘Units’ you want – like 0.1 BTC.

Give everything a final check, and when you’re good to go, hit:

– ‘Set Order’ if you’re rolling with a Limit order

– ‘Open Trade’ if you’re jumping in with a Market order and want to invest right away.

This is where the real action starts in your trading journey!

And that’s the end of the investment process.

Step 6: Review and Confirm Your Order

Prudent traders always review their decisions before committing. Scrutinize the order details, including the investment amount and order type. Once satisfied, click on the “Open Trade” button to execute your purchase. This marks the culmination of your carefully considered decision to buy Bitcoin on eToro.

Step 7: Monitor Your Investment

The thrill of cryptocurrency trading lies in monitoring your investment’s performance. On the eToro platform, real-time price charts, portfolio insights, and market news are at your fingertips. Stay informed about market trends, track your portfolio’s growth, and make data-driven decisions to enhance your overall trading experience.

Step 8: Set Up the eToro Bitcoin Wallet App [Optional]

Once you’ve bought Bitcoin on eToro, you’re all set until you decide to sell. eToro takes care of keeping your Bitcoin safe with its custodial web storage, so there’s no need to stress about getting a separate wallet. It’s not just safe; it’s super convenient.

But here’s the thing – if you want to make Bitcoin transfers, the eToro web wallet won’t do the trick. No worries, though, because eToro has you covered with one of the best crypto wallets for iOS and Android. The eToro wallet app lets you send and receive Bitcoin, giving you more flexibility.

And here’s a cool feature – the eToro wallet app supports automatic token swaps. That means you can trade your Bitcoin for other top cryptocurrencies like Ethereum or XRP.

Getting the eToro wallet app is easy. Just click on the ‘Google Play’ or ‘App Store’ button to download it. After that, open the app and sign in using your eToro username and password. It’s a breeze!

How to Transfer Bitcoin to the eToro Wallet App

To move your Bitcoin to the eToro wallet app, follow these simple steps:

- Start by clicking on the ‘Portfolio’ button from your eToro dashboard.

- Next, select ‘Bitcoin’ and then click on ‘Edit Trade.’

- Look for the ‘Transfer to eToro Money Wallet’ button and click on it to finalize the transfer.

- Once the transfer is done, you’ll see your Bitcoin tokens in your eToro wallet app.

That’s it! It’s an easy process to ensure your Bitcoin is securely transferred to your eToro wallet app.

Step 9: How to Sell Bitcoin on eToro

Selling Bitcoin on eToro is super easy, and you can do it anytime, day or night. Here’s a simple guide:

- Click on ‘Portfolio’:

- Start by clicking on the ‘Portfolio’ button.

- Choose Your Bitcoin:

- Look for your Bitcoin in the portfolio and click on it.

- Click ‘Close’:

- Hit the ‘Close’ button to start the selling process.

- Review and Confirm:

- Take a moment to review your sell order details. If everything looks good, click on ‘Close Trade.’

- Instant Sale:

- eToro will quickly sell your Bitcoin, and you’ll see your cash balance go up.

- Manage Your Funds:

- Now, you have options. You can withdraw your cash or use it to invest in something else.

That’s it! Selling Bitcoin on eToro is a breeze, and you have the flexibility to manage your funds as you like.

Note: If you don’t want to sell all your Bitcoin at once and just prefer to cash out a portion, it’s easy on eToro. Just check the “Close Only Part of the Trade” button. Then, specify the amount of Bitcoin you want to sell before clicking on ‘Close Trade.’ This way, you have the flexibility to manage your Bitcoin holdings the way that suits you best.

Step 10: Why Use eToro to Invest in Bitcoin?

Using eToro to invest in Bitcoin offers several advantages, making it a popular choice for many investors. Here are some reasons why people choose eToro:

- User-Friendly Platform:

- eToro provides a user-friendly platform, making it accessible for both beginners and experienced traders. The intuitive interface and straightforward navigation make it easy to buy, sell, and monitor investments, including Bitcoin.

- Social Trading Features:

- One unique aspect of eToro is its social trading features. Users can see and replicate the trades of successful investors on the platform. This is beneficial for those who are new to trading or want insights from seasoned traders.

- Variety of Assets:

- In addition to Bitcoin, eToro offers a wide range of assets for trading, including other cryptocurrencies, stocks, commodities, and more. This diversity allows investors to build a diversified portfolio within a single platform.

- Regulation and Security:

- eToro is regulated by financial authorities in multiple jurisdictions, providing a level of security and compliance with industry standards. This regulation can contribute to user confidence and trust in the platform.

- Custodial Wallet:

- eToro provides a custodial wallet service for users, eliminating the need for them to manage a separate wallet. This convenience is appreciated by those who prefer an all-in-one solution for trading and holding their Bitcoin.

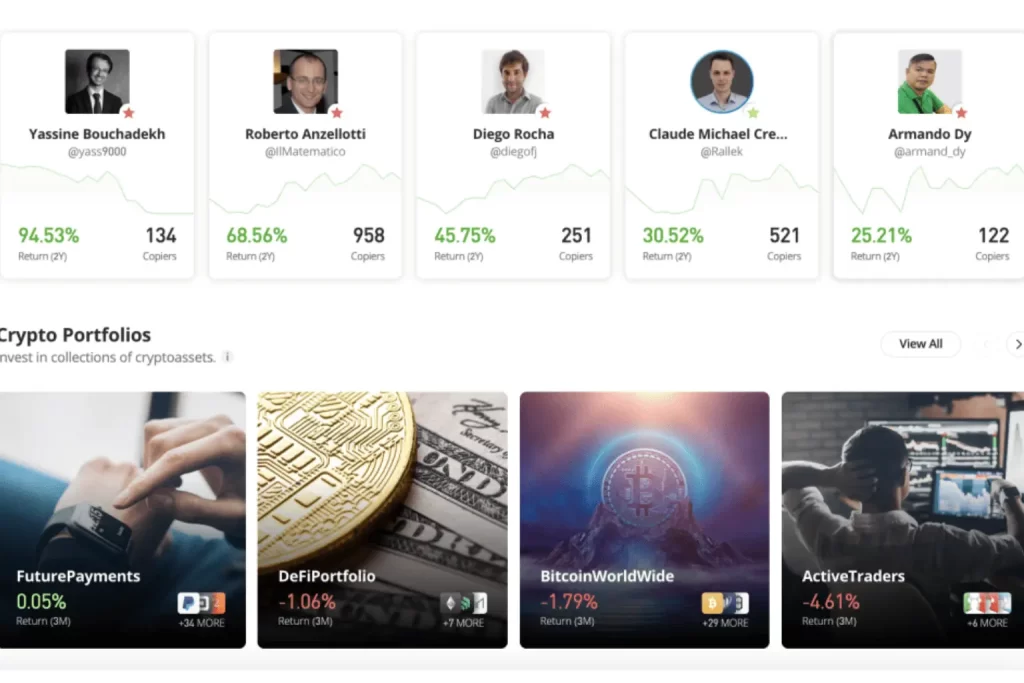

- CopyTrading Feature:

- eToro’s CopyTrading feature allows users to automatically replicate the trades of successful investors. This is especially beneficial for those who may not have the time or expertise to actively manage their portfolios.

- 24/7 Market Access:

- eToro allows trading 24 hours a day, seven days a week, providing flexibility for users in different time zones or with varying schedules.

- Educational Resources:

- eToro offers educational resources and market analysis, helping users make informed investment decisions. This is valuable for both beginners looking to learn and experienced traders seeking additional insights.

eToro Review 2023

eToro stands out as a well-established trading platform boasting a user base of over 30 million clients since its launch in 2007. The platform has obtained tier-one licenses from various financial bodies, ensuring a high level of regulatory compliance. Notably, eToro is regulated by FINRA in the US, the FCA in the UK, and is subject to additional oversight from ASIC in Australia and CySEC in the EU. An added layer of security is provided by the segregation of client-owned funds in dedicated bank accounts.

Furthermore, eToro falls under the protection of the UK’s FSCS (Financial Services Compensation Scheme), offering coverage of up to £85,000 per client in the event of brokerage collapses. Operating as a multi-asset trading platform, eToro supports a diverse range of markets.

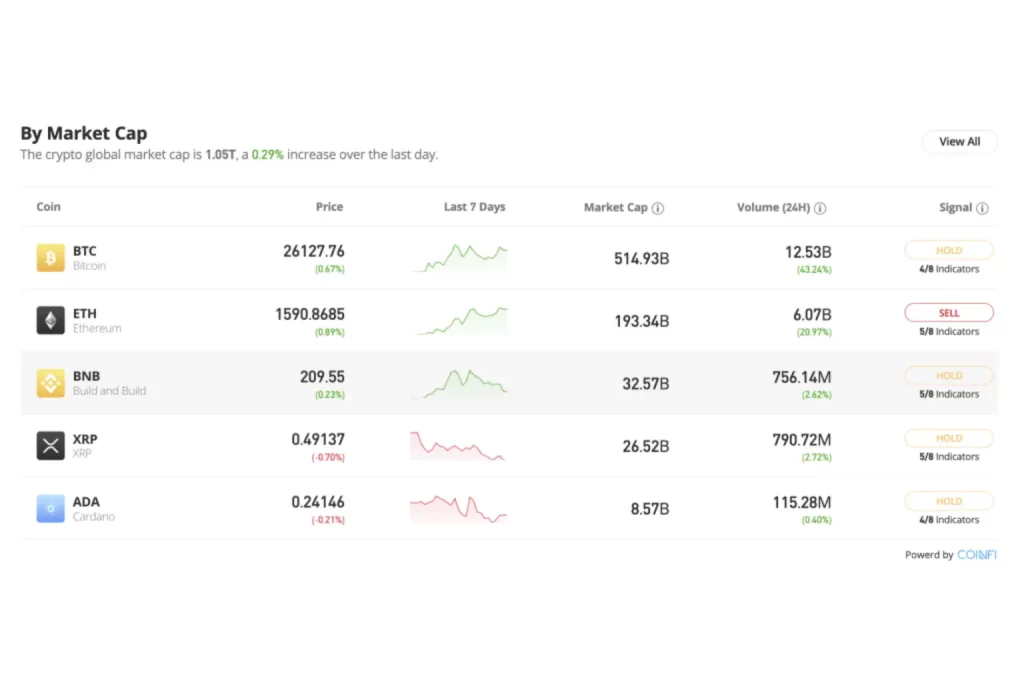

For cryptocurrency enthusiasts, eToro provides access to leading digital assets like Bitcoin, Ethereum, XRP, Cardano, and Solana. It also caters to those interested in up-and-coming cryptocurrencies such as Compound, Immutable X, ApeCoin, Band Protocol, and many others.

Beyond cryptocurrencies, eToro offers a vast selection of over 3,000 stocks and ETFs, covering exchanges in the US, Europe, Asia, and more. The platform also supports CFD trading markets, including commodities, indices, and forex. However, it’s important to note that CFD products are not available to clients in the US.

In terms of fees, eToro adopts a varied approach based on the asset class. While cryptocurrency trading incurs a 1% commission, stocks and ETFs can be purchased with a 0% commission. CFD markets, such as forex and gold, operate on a spread-only basis. Although eToro’s cryptocurrency trading commissions are comparatively higher than some providers, the platform compensates with competitive deposit fees, particularly for US dollars, which can be deposited via debit/credit card or e-wallet at no cost.

eToro’s technical analysis tools, while catering to beginners with indicators and charts, might be considered basic for advanced traders. However, the platform makes up for this with features like sell-side analyst ratings, social sentiment bars, fundamental data, and news feeds. eToro also offers automated trading tools, including ‘copy trading,’ allowing users to replicate the strategies of experienced investors. Additionally, ‘smart portfolios’ offer managed portfolios containing cryptocurrencies and/or stocks, albeit with a minimum investment requirement of $500. For those looking to trade Bitcoin on eToro, the minimum requirement is a modest $10.

Pros

- Rated as ‘Excellent’ on TrustPilot across over 21,000 reviews

- Regulated by several tier-one bodies – including the FCA, FINRA, ASIC, and CySEC

- Buy Bitcoin and dozens of altcoins from $10

- Copy trading tool supports automated investing

- Fee-free debit/credit card and e-wallet payments

- Research tools including analyst ratings and news

- User-friendly dashboard will appeal to beginners

Cons

- Experienced traders will find eToro too basic

- High cryptocurrency trading commissions of 1%

Step 11: How Much Does It Cost to Buy Bitcoin on eToro?

In this section, we’ll outline what fees you’ll pay when buying Bitcoin with eToro.

Deposit Fees

Whether you’ll encounter deposit fees on eToro depends on the currency you’re using.

For US dollars: No fees are charged when depositing funds.

For other currencies (e.g., euros or yen): A 0.5% FX conversion fee applies. This is because eToro operates exclusively in US dollars.

Now, let’s compare this with other crypto exchanges. Earlier, we mentioned that Coinbase and Gemini charge 3.99% and 3.49% on debit/credit card payments. It’s important to note that these fees also include the trading commission. On average, top-tier exchanges typically charge between 3-5% on fiat money deposits. In this regard, eToro stands out as a competitive option.

Withdrawal Fees

For eToro users in the United States, there are no withdrawal fees imposed. However, for users outside the US, a standard fee of $5 is applicable for all withdrawals, irrespective of the withdrawal amount or the chosen payment method.

Does eToro Have a Minimum Withdrawal Amount?

Yes, eToro has a minimum withdrawal amount of $30. If your balance is below this threshold, you won’t be able to cash out. Also, don’t forget to factor in the $5 withdrawal fee if you’re a non-US client.

Trading Fees

eToro maintains a transparent and uncomplicated fee structure for Bitcoin trading, with a fixed rate of 1% applicable to all supported cryptocurrencies. This fee is seamlessly integrated into the spread and is incurred both when buying and selling assets.

To illustrate, if you invest $1,500 in Bitcoin, the 1% fee amounts to $15. Consequently, your effective investment value becomes $1,475, requiring a $15 increase to reach the break-even point. When selling Bitcoin at a portfolio value of $4,000, the 1% fee results in a $40 commission, leaving you with a cash-out value of $3,960.

While eToro’s pricing structure is perceived as relatively expensive, it’s important to note that the 1% fee mirrors platforms like Webull, which, although commission-free, incorporates a 1% spread. In comparison, platforms such as Binance and OKX charge a lower fee of 0.1% on Bitcoin trades. However, when considering overall costs, it’s crucial to factor in deposit fees, where eToro’s competitive 0-0.5% range depending on the currency stands out.

Bitcoin Storage Fees

Following your Bitcoin purchase on eToro, you won’t encounter any additional fees until you decide to cash out. This is due to the fact that eToro’s wallet storage service is provided free of charge.

Bitcoin Transfer Fees

Transferring Bitcoin to the eToro wallet app is entirely optional; you can conveniently retain your BTC tokens in the eToro web wallet without incurring any charges. However, should you prefer the added flexibility of transferring Bitcoin to the eToro wallet app, a 2% fee is applicable. It’s worth noting that this fee is subject to a minimum charge of $1 and a maximum of $100.

Summary of eToro Fees:

Here’s a summary table of what fees to expect when you buy Bitcoin with eToro:

| Fee Type | Fee |

|---|---|

| Deposits | USD deposits are free. Other currencies are charged 0.5%. |

| Withdrawals | USD withdrawals are free. Other currencies are charged $5. |

| Trading | 1% commission on buy and sell orders. |

| Bitcoin Storage | No fees |

| Transfer to eToro Wallet App | 2% fee (Min/Max $1/$100) |

Step 12: How do Fractional Bitcoin Investments Work?

– With Bitcoin’s current price surpassing $26,000,

– eToro’s backing of fractional investments allows for a minimal risk of just $10.

– This means you have the opportunity to acquire a small fraction of a Bitcoin token.

– Consider investing a minimum of $10; at a Bitcoin price of $26,000, you would possess approximately 0.038% of a Bitcoin token.

– This feature empowers you to venture into Bitcoin investment on eToro without exposing yourself to a significant financial risk.

Security and Regulation

In the latter part of 2022, FTX, one of the world’s largest exchanges, filed for bankruptcy, sending shockwaves through the cryptocurrency landscape. This incident served as a stark reminder to investors about the paramount importance of prioritizing safety when engaging in the crypto market. Essentially, it underscores the significance of choosing an exchange that adheres to adequate regulatory standards.

This is where eToro shines as a platform. Notably, eToro is regulated by four tier-one licensing bodies, providing a robust framework for its operations:

– FINRA: US

– ASIC: Australia

– CySEC: EU

– FCA: UK

These regulatory bodies play a crucial role in overseeing eToro’s activities. For instance, eToro is obligated to keep client funds in segregated bank accounts, ensuring that investor funds, including digital assets, are not utilized for the platform’s operational expenses. This safeguard extends even in the unlikely event of eToro facing bankruptcy, assuring the safety of your funds.

Additionally, eToro boasts institutional-grade security measures. It employs cold storage for client-owned cryptocurrencies, keeping them isolated from live servers and impervious to hacking attempts. The platform enhances account security through two-factor authentication. Furthermore, if you opt for the eToro wallet app, it is licensed by the GFSC (Gibraltar).

In summary, despite eToro’s comparatively higher trading commissions on cryptocurrencies, investors can take comfort in the fact that they are entrusting their funds to a secure and regulated platform.

Step 13: How Much Money Do You Need to Buy Bitcoin on eToro?

When embarking on Bitcoin purchases with eToro, it’s crucial to be mindful of two minimum thresholds:

– Initially, you must fulfill the minimum deposit requirement, which stands at $10 for US and UK clients. For others, the minimum deposit is marginally higher, set at $50.

– Subsequently, there is the minimum trade requirement, set at a modest $10 for both buying and selling Bitcoin.

It’s worth noting that a minimum withdrawal requirement of $30 applies. These minimums are essential considerations for users engaging in Bitcoin transactions on the eToro platform.

Conclusion

Navigating the intricate landscape of buying Bitcoin on eToro requires a blend of knowledge, strategy, and intuition. This guide has equipped you with the tools needed to embark on your cryptocurrency journey confidently. As you delve into the dynamic world of Bitcoin trading, remember to conduct thorough research, stay informed about market developments, and embrace the ever-evolving nature of the cryptocurrency space. Happy trading!

FAQ’s

Read also Are Sinus Infections Contagious: Discover In 8 Crucial Steps